Collecting, processing, and reporting sustainability data is time-consuming and laborious. With efficient data management, we automate your ESG reporting process: from data collection to calculation of desired KPIs.

“We make reporting on sustainability easy & auditable.”

With our expertise at the interface of data and real estate, we have developed an efficient and modern data infrastructure for the processing of ESG data in cooperation with the leading real estate service provider Wincasa. The platform enables the flexible and automated integration of a variety of ESG-relevant data sources.

This means that the required key figures and reports can be generated automatically in the desired format.

Automated collection of energy, water and waste data. Data structuring and quality checks. Access to data via our intelligent ESG application.

>> Learn more

Calculation of all relevant KPIs based on consumption data (e.g. CO2 intensity). Includes all environmentally relevant KPIs required by AMAS/KGAST/ASIP.

Calculation of the CO2 reduction pathway or climate pathway for individual properties or an entire portfolio.

Providing benchmarking data based on the universe of indirect real estate investments in Switzerland (e.g. SWIIT, KGAST or selected products).

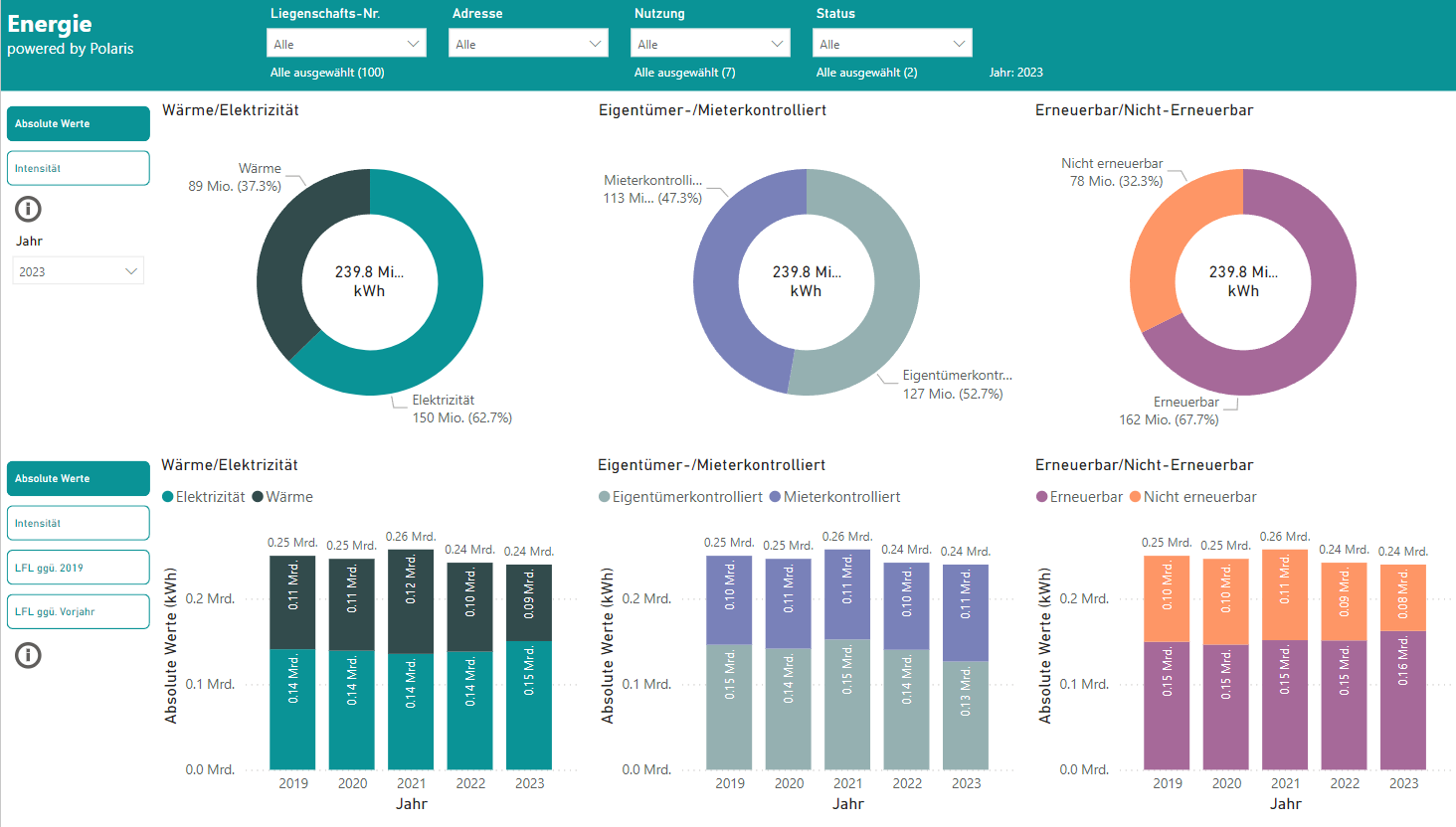

Intuitive analysis of data in an interactive dashboard. A wide range of filtering options and the ability to embed data and graphs directly into a presentation.

Optimisation of data flows for specific reports. Automating reports for benchmarks and certificates such as REIDA, GRESB, BREEAM, etc.

The measurability and traceability of sustainability goals is playing an increasingly important role for real estate owners. Members of the Asset Management Association Switzerland (AMAS) are required to publish all environment-related key figures in a standardised format. There are also binding standards at European level in the form of the EU Taxonomy and the CSRD. However, the reporting of ESG data is very time-consuming and laborious, as the necessary data is often stored in different data sources or has to be collected in a structured manner in the first place. The manual collection and preparation of data for the various standards and benchmarks is time-consuming and, above all, error-prone. ESG Data Management can automate these processes and guarantee high data quality at the same time. This frees up resources to focus on the essentials: analysing the data and optimising the building stock.

The data infrastructure can be customised for any ESG reporting. If the necessary database is available, the desired KPIs can be generated in the required format. Our solution can be used to fill in individual KPIs (e.g. according to AMAS, KGAST, ASIP, ESRS) as well as complete templates (e.g. GRESB Asset Spreadsheet, REIDA Template) or generate complete reports (e.g. sustainability report for annual reports).

We support our customers throughout the entire ESG data journey, starting with the collection of the necessary data. We always endeavour to automate the processes as much as possible.

Some of the data required for ESG reporting is not yet available in a source system (e.g. energy, waste, investment planning). In these cases, we support you in the structured collection of data using specific input masks in our co2lect application or the option to upload Excel/CSV files.

Various data is already available in source systems (e.g. surface area data). Wherever possible, direct access to the source system is sought in order to minimise manual effort. Alternatively, the data can be exported from the systems as structured Excel/CSV or PDF files and thus integrated into the infrastructure.

For consumption invoices, we also developed an intelligent algorithm that can read the data from invoices.

The collection of energy data is crucial for ESG reporting. Our smart ESG application co2lect supports you in the collection, management, processing and quality control of your consumption data (energy, water, heat).

More and more owners are collecting their energy data via smart meters. The data can be aggregated and integrated directly into co2lect. If no smart meter solution is yet available, some of the data can be obtained directly from the energy company in structured form or there is an interface to their source system.

Until all data collection processes are automated, consumption bills often remain the only source of data. To avoid having to laboriously read these out by hand, we have developed an intelligent AI-based algorithm that can automatically read the data from PDF invoices or even scans of invoices and integrate it directly into co2lect.

A combination of human and artificial intelligence is used to automatically check the quality of the data integrated into the ESG infrastructure. These are rule-based and check, for example, whether a value is within the defined range of last year’s value. On the other hand, outliers in the data are identified, i.e. data points that deviate significantly from the general mean are reported.

The results of the various data quality checks are processed in an interactive quality report. This report enables to quickly find errors and warnings in the data.

The pressure for sustainability from investors is also increasing for smaller property owners. Various associations such as AMAS, KGAST and ASIP have defined environment-related KPIs that must be published. European standards such as DNK or ESRS have also defined reporting guidelines. All standards now require detailed data on the energy consumption of all properties in the portfolio.

Often, smaller companies in particular do not have standardised processes for collecting this data, and the data is collected manually in a time-consuming process. This is not only time consuming but also prone to error.

Our data infrastructure and the associated co2lect application are flexible and can be tailored to individual requirements. For example, if only the AMAS KPIs are relevant, the data infrastructure is correspondingly smaller and primarily processes all energy consumption data. Automating the data collection and KPI calculation processes saves a lot of time and ensures high data quality.

Our ESG data infrastructure can also be continuously adapted to new and growing needs by integrating new data sources and generating additional metrics.

Ensuring high data quality is essential for the accuracy and credibility of certifications as well as the accuracy and reliability of analyses and data-based decisions. Automated data quality checks are therefore central to our ESG platform.

The data infrastructure developed complies with the guidelines of the International Standard on Assurance Engagements (ISAE) and therefore enables the proof of appropriate controls for the data preparation of ESG-relevant information with regard to security, availability, confidentiality, integrity of processing and data protection. All processes are fully documented and the calculation of KPIs is reported transparently.

We would be happy to discuss your needs in a personal meeting.